In The News

Evolving Technology in the Heavy Civil Construction Industry

The TEQ Fall Issue features S&B USA and an in-depth look at how evolving technology is transforming the heavy civil construction industry.

Modernizing the Pennsylvania Turnpike's Beaver River Bridge

"The goal of this project is to efficiently replace a steel truss bridge with two modern, cast-in-place segmental bridge structures to carry motorists and commercial trucks over the Beaver River and CSX and Norfolk Southern railroad lines."

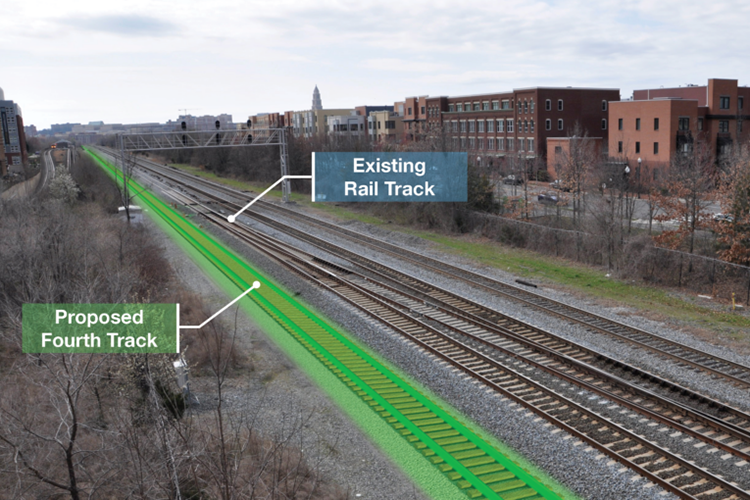

Skanska-Fay Joint Venture Announces Substantial Completion of CSX's Howard Street Tunnel Modernization Project

Progressive design-build delivery brings project ahead of initial schedule

Growth and Gaps: Addressing the Infrastructure Workforce Challenge

This blog post discusses the upcoming workforce challenge the construction industry is facing and how S&B USA is addressing it.

S&B USA Recognized by PA Chamber as a Greatest Place to Intern in PA

S&B USA was named a Greatest Place to Intern in PA by the Pennsylvania Chamber of Business and Industry. The award celebrates Pennsylvania employers who create dynamic, engaging, and educational experiences for their interns.

S&B USA Releases 2024 Annual Sustainability Report

With the release of our second Annual Sustainability Report, S&B USA provides details about our continuing commitment to initiatives and progress on sustainable practices and innovations in our work for public and private infrastructure owners.

Beaver River Bridge Replacement Project Showcased During International Bridge Conference

The total reconstruction and replacement of the Pennsylvania Turnpike's (PA Turnpike) Beaver River Bridge in North Sewickley Township, Beaver County is garnering international attention at the International Bridge Conference (IBC), held in Pittsburgh July 14-16.

Meet Us at the 2025 International Bridge Conference

Plan to visit S&B USA Construction (booth #111) at the 2025 International Bridge Conference in Pittsburgh to learn how we are contributing to impactful bridge design and construction.

Largest Contract in Pennsylvania Turnpike History to Replace Beaver River Bridge Near Pittsburgh

Read this article by CONSTRUCTIONEER to learn how Fay, S&B USA Construction is part of replacing one of the oldest structures on the Pennsylvania Turnpike.

20 People to Know in Construction and Development: James McNelis

Read about Jim McNelis, our recently appointed CEO of S&B USA Construction, who was featured in the Pittsburgh Business Times as one of the Pittsburgh region's construction leaders to know.

Pa. Turnpike's new Beaver County bridges, opening in 2027, will ease traffic — for $294 million

This article from the Pittsburgh Post-Gazette about the Beaver River Bridge Replacement project goes into the purpose of the project and the bridge's atypical construction.

Flying through the sky: Building the Beaver River Bridge replacement

This article is from the Pittsburgh Union Progress, and is written by Ed Blazina.